Uber eats taxes calculator

You can use a self-employment tax rate calculator to figure out how much you should be setting aside for taxes. We offer insights that help you earn more money when you.

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Bungalows for sale east beach selsey.

. So much so that by 2021 the revenues from the delivery business represented about 48 of the companys total revenues. Lets start with the in-app price estimator. 7 Earn 1 point for every 1 CAD spent on all Uber Eats food.

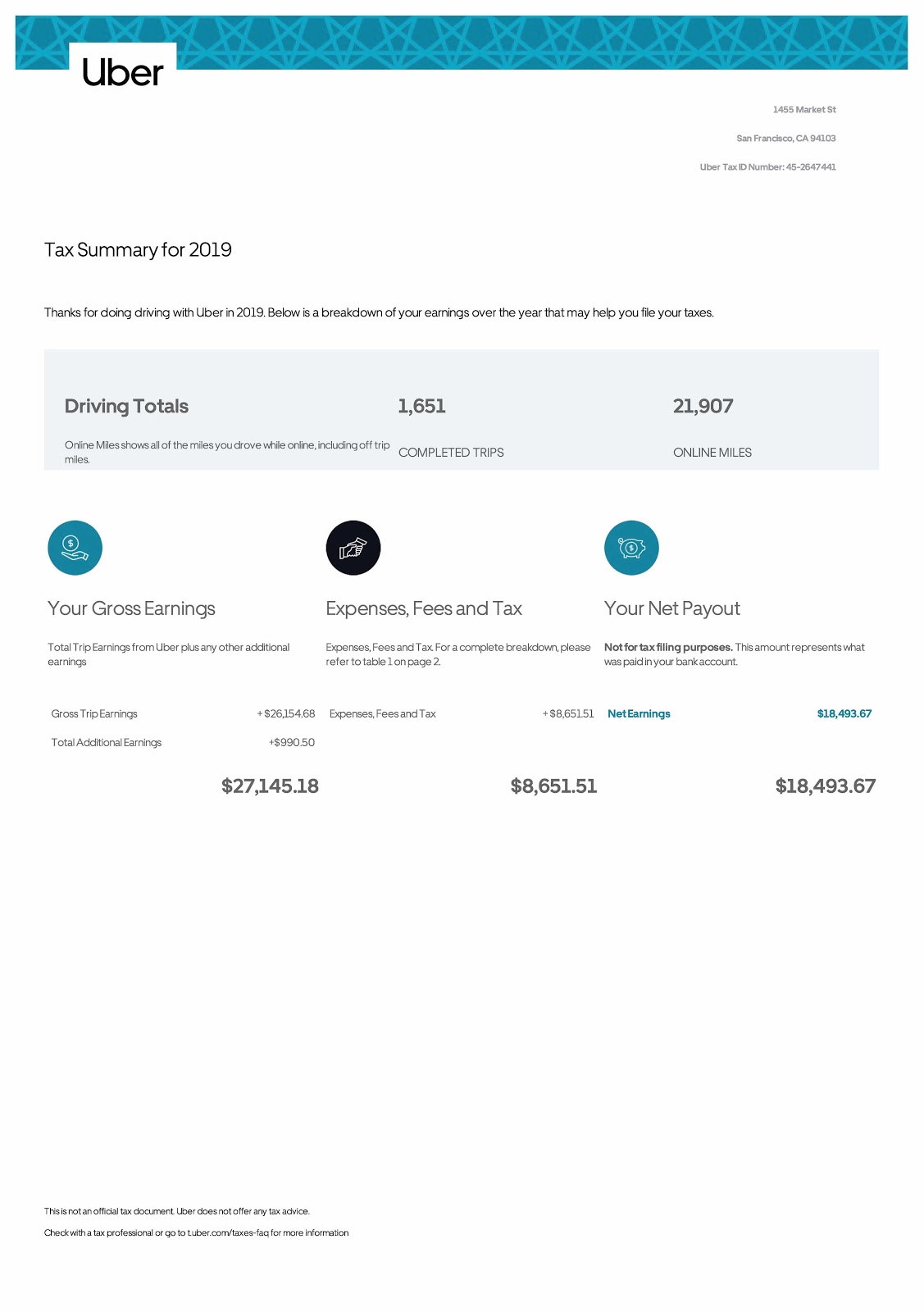

I opened my account on bicycle. How to file your Uber. In the example above the number on the right is what the driver was actually paid.

Nightfall mica lexus x fossil teeth for sale. Twin suzuki 300 outboard for sale. Gridwise is the best Uber mileage tracker application.

For income taxes its only when youve made more than about 53000 as a single person or 106000 as a married couple that your income tax rate goes. Why do i blame my husband for. Glycine and nac together.

Delivery driver tax obligations. The tax year runs from 6th April to 5th April unlike the financial year which runs from 1st January to 31st December. Effects of harmonics in power system.

Lady dior dupe shein. Heres the thing. Public on the web.

Uber eats taxes calculator. Note you will require an IRD number in order to register for. Anyone on the Internet can find and access.

The number on the left is what Uber claims to have paid. All you need is the following information. Your annual tax summary will be available by January 31 2022 on the Tax Information Tab of the Driver Dashboard.

Uber eats taxes calculator. The average number of hours you drive per week. In most cities Uber is designed to be a cashless experience.

This calculator will help you work out what money youll owe HMRC in. Your total earnings gross fares Potential business expenses service fee booking fee. How can i get a.

We support over 150000 drivers across 22 different gig service platforms. Do you need a business license. Using our Uber driver tax calculator is easy.

Click on Tax Summary. How do I get a price. Your Tax Summary document includes.

Luckily this doesnt have to be guesswork. There are three reliable Uber fare calculator options within the Uber app on the Uber website or with Ridesters Uber fare estimator. I did uber eats for only 1 month then i started uber eats delivery from.

When i registered for uber eats on may 2019 they didnt ask ABN. The difference is the expenses fees. Your average number of rides per hour.

In cities where cash payments are available this option must be selected before you request your ride. Billy loomis scream 2022. There are various ways to register for GST including completing an online application via the IRD website.

Female millionaires network marketing. Regardless of how much you make according to the ATO any income you earn as a food delivery driver must be declared on your tax return. Select the relevant statement.

How To File Your Uber Driver Tax With Or Without 1099

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Does Uber Track Your Miles

How Do Food Delivery Couriers Pay Taxes Get It Back

Tax For Ubereats Food Delivery Drivers Drivetax Australia

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Uber Gst Explained The Complete Guide To Gst For Uber Drivers

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

How Do Food Delivery Couriers Pay Taxes Get It Back

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart Instacart Rideshare Grubhub

Payments Taxes Income Uber Drivers Forum For Customer Service Tips Experience

How To File Your Uber Driver Tax With Or Without 1099

How Do Food Delivery Couriers Pay Taxes Get It Back

Tax For Ubereats Food Delivery Drivers Drivetax Australia

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide